Loading content …

Debt Advisory & Deal Origination

About Us

BF.real estate finance is an independent specialist for the advisory, structuring and brokering of residential and commercial real estate financing arrangements (real estate debt advisory). To this end, BF.real estate finance relies on a wide network of the most diverse finance partners, and therefore has access to every available financing component along a given capital structure: debt, mezzanine or equity capital and possible hybrid variations thereof.

Clients of BF.real estate finance include, on one hand, renowned contractors, developers, (listed) property companies and real estate funds. On the other hand, the company serves banks, mezzanine lenders, whole-loan providers, insurance companies, pension funds and family offices inside and outside Germany.

The company is a fully-owned subsidiary of BF.direkt AG. The group as a whole arranges lending volumes of more than one billion euros annually, and currently employs over 50 staff.

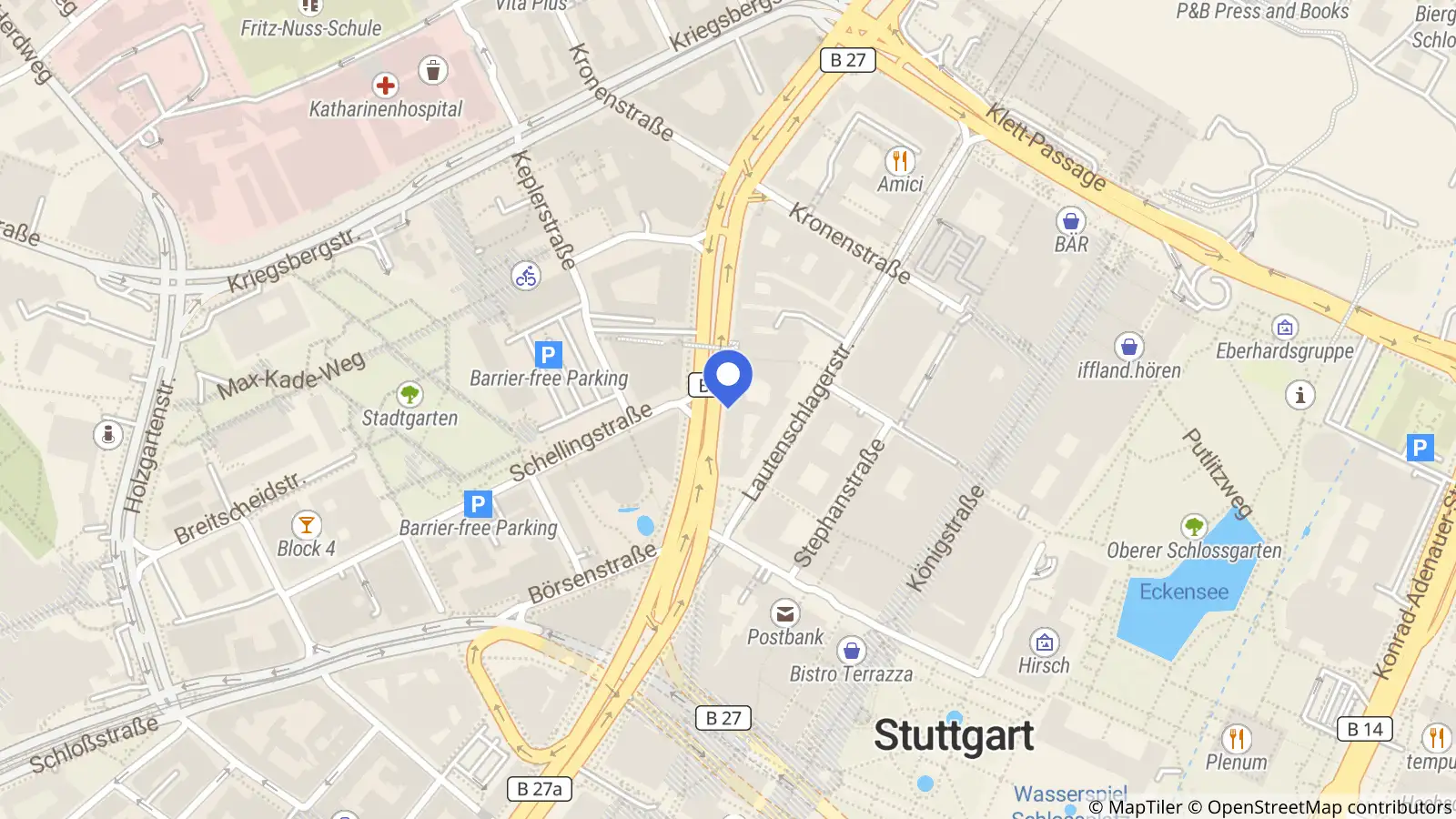

BF.real estate finance maintains branch offices in Stuttgart, Berlin, Frankfurt am Main, Munich and Dusseldorf.

Branches

Jägerstraße 60

10117 Berlin

Friedrichstraße 23 a

70174 Stuttgart

Barer Straße 1

80333 Munich

Management

Managing Director

Francesco Fedele is the founder and CEO of BF.direkt AG. In this role, he is responsible for strategically positioning the company on the market and for sales. He also serves as Managing Director of BF.real estate finance and shares responsibility for the operating activities with Fabio Carrozza. Fedele began his professional career with a major insurance group in 1982. In 1992, he formed the company Fedele BauFinanz GmbH & Co. KG, the legal precursor of BF.direkt AG. As founder and majority shareholder of BF.direkt AG, he has many years of experience in the acquisition, structuring and placement of commercial real estate financing arrangements.

Managing Director

Fabio Carrozza has been with the BF Group since October 2020. He is in charge of the sales staff in the company’s branch offices in Stuttgart, Berlin, Frankfurt am Main and Munich. Fabio Carrozza has long-term experience in the management of corporate and real estate clients and in the structuring of corporate, property and portfolio financing arrangements. Before joining the BF Group, he spent more than 20 years in the banking sector in a variety of roles and responsibilities after obtaining a degree in business economics.

Services

Debt Advisory & Deal Origination

As one of Germany’s leading financial advisors, BF.real estate finance develops bespoke funding strategies for its clients, and finds the right finance partners for them. Deliverables include the advisory, structuring and brokerage of residential and commercial real estate financing arrangements. For its real estate clients, BF.real estate finance provides the following services:

- “one-stop” financing without proprietary loan book

- excellent industry network and extensive market overview

- regional and national networking reach that includes banks and non-bank alternative finance partners

- offices in Stuttgart, Berlin, Frankfurt am Main, Munich and Dusseldorf

- in-house analysis and structuring competence

Tenders for Mutual and Institutional Property Funds

Specifically for mutual and institutional property funds, we offer end-to-end origination of real estate financing arrangements for real estate of any asset class.

- Designing and creating financing teasers (existing properties, property developments)

- Engaging finance partners (banks, insurance companies, alternative financiers, etc.) while simultaneously controlling the organisational and operational aspects of the financing process

- Compiling a comparative overview of the various financing offers

- Facilitating the structuring of loan and collateral agreements, including the negotiation of optimal terms

- Coordinating and attending reconciliation cycles for the purpose of implementing the agreements, involving proprietors, attorneys, front and back office business units, etc.

- Facilitating the fulfilment of the conditions precedent for disbursement

- Procuring the relevant authorisations

Credentials

BF.real estate finance acts as “one-stop” financier without proprietary loan book, maintaining an excellent industry network and having broad-based access to the most diverse borrowers and lenders.

Players on the borrower side include contractors, property developers, (listed) real estate companies and property funds. On the lender side, BF.real estate finance draws on its excellent network connections to banks, mezzanine lenders, whole loan providers, insurance companies, pension funds as well as family offices inside and outside Germany.

The company is a fully-owned subsidiary of BF.direkt AG. The group as a whole arranges lending volumes of more than one billion euros annually, and currently employs over 50 staff.

BF.real estate finance maintains branch offices in Stuttgart, Berlin, Frankfurt am Main, Munich and Dusseldorf.

Check below for some examples of recent financing arrangements:

September

2025

12.5m EUR

Transaction volume

Inventory financing in Stuttgart

August

2025

31.4m EUR

Transaction volume

Inventory financing in Berlin

July

2025

24.5m EUR

Transaction volume

Inventory financing in Hildesheim

July

2025

4.4m EUR

Transaction volume

Inventory financing in Berlin

June

2025

15m EUR

Transaction volume

Inventory financing in Gaggenau

December

2024

448m EUR

Transaction volume

Inventory financing Residential Portfolio

December

2024

10m EUR

Transaction volume

Property development financing in Berlin

December

2024

20.1m EUR

Transaction volume

Inventory financing in Linz

December

2024

320m EUR

Transaction volume

ReDevelopment in Erding

October

2024

3.9m EUR

Transaction volume

Inventory financing in Baden-Württemberg

September

2024

38.9m EUR

Transaction volume

Property development financing in Hamburg

September

2024

4.7m EUR

Transaction volume

Property development financing in Essen

August

2024

1.9m EUR

Transaction volume

ReDevelopment in Kassel

August

2024

10.2m EUR

Transaction volume

Inventory financing in Berlin

July

2024

12.9m EUR

Transaction volume

Inventory financing in Munich

May

2024

27.9m EUR

Transaction volume

ReDevelopment in Berlin

March

2024

18m EUR

Transaction volume

Inventory financing in Wiesbaden

March

2024

18m EUR

Transaction volume

Inventory financing in Wiesbaden

March

2024

24.4m EUR

Transaction volume

Inventory financing in Augsburg

February

2024

11.5m EUR

Transaction volume

Property development financing in Düsseldorf

January

2024

23.9m EUR

Transaction volume

Property development financing in Leipzig

December

2023

18m EUR

Transaction volume

Inventory financing in Bremen

December

2023

17.6m EUR

Transaction volume

Property development financing in Berlin

December

2023

37.1m EUR

Transaction volume

Property development financing in Leipzig

November

2023

6.6m EUR

Transaction volume

Inventory financing in Berlin

November

2023

15.6m EUR

Transaction volume

Property Development in Saxony-Anhalt

September

2023

13.4m EUR

Transaction volume

Property development financing in Brandenburg

August

2023

3.3m EUR

Transaction volume

Inventory financing in Leipzig

July

2023

6m EUR

Transaction volume

Projektentwicklung in Leipzig

July

2023

8.5m EUR

Transaction volume

Inventory financing in Saxony-Anhalt

June

2023

13m EUR

Transaction volume

Inventory financing in Saxony-Anhalt

June

2023

12.7m EUR

Transaction volume

Inventory financing in North Rhine-Westphalia

June

2023

9.2m EUR

Transaction volume

Property development financing in Leipzig

June

2023

11.5m EUR

Transaction volume

Property development financing in Brandenburg

June

2023

7.7m EUR

Transaction volume

Property development financing in Berlin

May

2023

4.7m EUR

Transaction volume

Property development financing in Saxony

April

2023

137m EUR

Transaction volume

Property development financing in Berlin

March

2023

24.7m EUR

Transaction volume

Property development financing in Mecklenburg-Vorpommern

March

2023

200m EUR

Transaction volume

Property development financing in Munich

February

2023

51.5m EUR

Transaction volume

Inventory financing in Berlin

February

2023

2.7m EUR

Transaction volume

Property development financing in Bavaria

February

2023

21.4m EUR

Transaction volume

Inventory financing in Frankfurt

December

2022

8.3m EUR

Transaction volume

Property development financing in Baden-Württemberg

December

2022

11.5m EUR

Transaction volume

Redevelopment in Stuttgart

November

2022

11m EUR

Transaction volume

Property development financing in Brandenburg

November

2022

3.4m EUR

Transaction volume

ReDevelopment in Baden-Württemberg

October

2022

5.3m EUR

Transaction volume

Property development financing in Berlin

October

2022

8.1m EUR

Transaction volume

Property development financing in Berlin

October

2022

7.95m EUR

Transaction volume

Property development financing in Berlin

October

2022

13.9m EUR

Transaction volume

Inventory financing in Dresden

September

2022

8.8m EUR

Transaction volume

Property development financing in Berlin

August

2022

30.5m EUR

Transaction volume

Inventory financing in Saxony-Anhalt

June

2022

5.2m EUR

Transaction volume

Property development financing in Hessen

June

2022

88m EUR

Transaction volume

Redevelopment in Erlangen

June

2022

4m EUR

Transaction volume

Property development financing in Leipzig

May

2022

5.3m EUR

Transaction volume

Property development financing in Berlin

May

2022

3.7m EUR

Transaction volume

Property development financing in Baden-Württemberg

April

2022

76m EUR

Transaction volume

Property development financing in Karlsruhe

April

2022

2.6m EUR

Transaction volume

Redevelopment in Stuttgart

April

2022

12.2m EUR

Transaction volume

Inventory financing in Mecklenburg-Vorpommern

April

2022

5.4m EUR

Transaction volume

Property development financing in Leipzig

April

2022

12m EUR

Transaction volume

Inventory financing in Berlin

April

2022

29.8m EUR

Transaction volume

Redevelopment in Cologne

March

2022

28m EUR

Transaction volume

Redevelopment in Lübeck

March

2022

14.7m EUR

Transaction volume

Property development financing in Bayreuth

March

2022

3.9m EUR

Transaction volume

Property development financing in Baden-Württemberg

March

2022

174m EUR

Transaction volume

Inventory financing in Munich

February

2022

14.1m EUR

Transaction volume

Redevelopment in Wuppertal

January

2022

11.5m EUR

Transaction volume

Inventory financing in Leipzig

January

2022

11.5m EUR

Transaction volume

Inventory financing in Lower Saxony

January

2022

12.3m EUR

Transaction volume

Inventory financing in Berlin

January

2022

12.7m EUR

Transaction volume

Inventory financing in Berlin

December

2021

8m EUR

Transaction volume

Property development financing in Singen

December

2021

4m EUR

Transaction volume

Property development financing in Berlin

December

2021

33.8m EUR

Transaction volume

Property development financing in Berlin

December

2021

38.9m EUR

Transaction volume

Property development financing in Frankfurt

December

2021

31.3m EUR

Transaction volume

Redevelopment in Stuttgart

November

2021

16.7m EUR

Transaction volume

Property development financing in Saxony

November

2021

12.7m EUR

Transaction volume

Redevelopment in Duisburg

November

2021

11.5m EUR

Transaction volume

Property development financing in Berlin

November

2021

15.5m EUR

Transaction volume

Inventory financing in Leipzig

November

2021

33m EUR

Transaction volume

Mezzanine/purchase financing in Berlin

November

2021

13.3m EUR

Transaction volume

Property development financing in Berlin

October

2021

5m EUR

Transaction volume

Inventory financing in Leipzig

October

2021

4.8m EUR

Transaction volume

Property development financing in Leverkusen

October

2021

15.3m EUR

Transaction volume

Purchase financing in Rostock

September

2021

39.7m EUR

Transaction volume

Property development financing in Saxony

September

2021

48m EUR

Transaction volume

Property development financing in Düsseldorf

September

2021

18.7m EUR

Transaction volume

Land purchase financing in Leipzig

September

2021

14m EUR

Transaction volume

Inventory financing in NRW

August

2021

5.3m EUR

Transaction volume

Land purchase financing in Heidelberg

July

2021

19.3m EUR

Transaction volume

Purchase financing in Berlin

July

2021

5m EUR

Transaction volume

Inventory financing in Leipzig

June

2021

Transaction volume

June

2021

81.2m EUR

Transaction volume

Property development financing in Stuttgart

June

2021

Transaction volume

May

2021

22m EUR

Transaction volume

Purchase/Mezzanine-financing in Brandenburg

May

2021

21.4m EUR

Transaction volume

Project development in Frankfurt am Main

April

2021

3.1m EUR

Transaction volume

Purchase financing in Berlin

April

2021

17.5m EUR

Transaction volume

Revitalization in Thuringia

April

2021

71.4m EUR

Transaction volume

Purchase financing in Düsseldorf

April

2021

6.6m EUR

Transaction volume

Partitioning measure in Berlin

March

2021

12m EUR

Transaction volume

Inventory financing in München

March

2021

11.9m EUR

Transaction volume

Partitioning measure in Berlin

February

2021

7m EUR

Transaction volume

Property development financing in Leipzig

February

2021

8.4m EUR

Transaction volume

Partitioning measure in Berlin

February

2021

5.7m EUR

Transaction volume

Land purchase financing in Leipzig

February

2021

17.9m EUR

Transaction volume

Project development in North Rhine-Westphalia

February

2021

29m EUR

Transaction volume

Portfolio financing in West Germany

January

2021

51.3m EUR

Transaction volume

Project development in Berlin

January

2021

4m EUR

Transaction volume

Property development financing in Berlin

January

2021

38.1m EUR

Transaction volume

Financing of a commercial portfolio

December

2020

4.1m EUR

Transaction volume

Inventory financing in Gera

December

2020

67m EUR

Transaction volume

Project development in Munich

December

2020

10.8m EUR

Transaction volume

Project development in Pforzheim

December

2020

27m EUR

Transaction volume

Project development in Erfurt

December

2020

4.5m EUR

Transaction volume

Mezzanine in Munich

December

2020

12.1m EUR

Transaction volume

Inventory financing in Berlin

December

2020

20.6m EUR

Transaction volume

Project development in Berlin

November

2020

6.1m EUR

Transaction volume

Partitioning measure in Berlin

November

2020

11.6m EUR

Transaction volume

Property developer financing in Brandenburg

October

2020

6.3m EUR

Transaction volume

Project development in Saxony-Anhalt

October

2020

5.7m EUR

Transaction volume

Inventory financing in Stuttgart

October

2020

10.3m EUR

Transaction volume

Property developer financing in Brandenburg

October

2020

56.9m EUR

Transaction volume

Portfolio financing in North Rhine-Westphalia

September

2020

80m EUR

Transaction volume

Land purchase financing in North Rhine-Westphalia

September

2020

19m EUR

Transaction volume

Allocation measure in Bavaria

September

2020

23.2m EUR

Transaction volume

Allocation measure in Lower Saxony

July

2020

4m EUR

Transaction volume

Property development financing in Leipzig

July

2020

6m EUR

Transaction volume

Land purchase financing in Berlin

June

2020

9.2m EUR

Transaction volume

Project development in Leipzig

June

2020

4.3m EUR

Transaction volume

Project development in Leipzig

May

2020

3.1m EUR

Transaction volume

Portfolio financing in Saxony-Anhalt

May

2020

4.3m EUR

Transaction volume

Project development in Saxony

May

2020

18.7m EUR

Transaction volume

Portfolio financing in North Rhine-Westphalia

March

2020

17.5m EUR

Transaction volume

Inventory financing in Hesse

March

2020

39m EUR

Transaction volume

Inventory financing in Brandenburg

January

2020

3.2m EUR

Transaction volume

Inventory financing in Berlin

December

2019

7.2m EUR

Transaction volume

Inventory financing in Leipzig

December

2019

9.8m EUR

Transaction volume

Inventory financing in Berlin

December

2019

4.3m EUR

Transaction volume

Inventory financing in Berlin

November

2019

10.7m EUR

Transaction volume

Inventory financing in Leipzig

November

2019

5.3m EUR

Transaction volume

Inventory financing in Saxony-Anhalt

October

2019

19.8m EUR

Transaction volume

Inventory financing in Köln

October

2019

4.7m EUR

Transaction volume

Inventory financing in Brandenburg

October

2019

6.8m EUR

Transaction volume

Inventory financing in Mecklenburg-Western Pomerania

October

2019

3.8m EUR

Transaction volume

Inventory financing in Berlin

October

2019

10.6m EUR

Transaction volume

Inventory financing in Berlin

Open Positions

Contact Person

Fabio Carrozza

Managing Director

T +49 (0) 711 / 22 25 44 100

s.pneebmmn@os-qverxg.qr

Our employees benefit from a positive and appreciative corporate culture, fascinating projects and subjects, with ample room for personal creativity and innovative ideas, tasks marked by high degrees of variety and responsibility, a modern office and work environment in inner-city locations along with an attractive compensation and benefits package.

Submit your application and become a member of the BF.real estate finance family!

Even if none of the openings currently advertised matches your search profile, feel free to submit your comprehensive (unsolicited) application documents via e-mail to orjreohat@os-qverxg.qr.

YOUR JOB

- Assisting our returning clients (property developers, contractors, developer splitting houses into freehold flats, commercial real estate investors) with the structuring and procurement of development and inventory financing arrangements.

- Autonomous acquisition of new clients, the focus being on the Munich metro region, and building long-term business relations.

- Acquiring and structuring real estate financing arrangements while taking suitable equity partners (internal/external) and various financing components (e. g. mezzanine) into account.

- Preparing requests for funding and teasers for our equity partners

- Autonomous responsibility for revenues

- Acquisition and onboarding of equity partners

YOUR PROFILE

- Professional training and/or degree in the areas of banking/real estate/finance

- Several years of professional experience in the real estate sector

- In-depth and comprehensive expertise in various real estate asset classes and in the field of real estate project financing.

- Advanced sales and customer orientation along with closing skills

- Advanced project analysis skills and structuring experience with a wide variety of financing components along the capital structure

- Familiarity and market and sector, e. g. through previous (sales) activities with a regional or inter-regional financial institution and/or debt advisor would be of advantage

- Good command of the English language

- Autonomous work style, capacity for teamwork, and strong communication skills

WHAT WE HAVE TO OFFER

- Fascinating projects, richly varied subject areas, and tasks with a high degree of responsibility

- Attractive compensation and benefits package

- Flat organisational structures and short lines of communication

- Modern work environment and high-end office accommodation in inner-city locations

Please submit your detailed application documents, also stating your salary expectations and earliest possible starting date, via e-mail to orjreohat@os-qverxg.qr.

Imprint

BF.real estate finance GmbH

Friedrichstr. 23a

70174 Stuttgart

Telephone +49 711 - 22 55 44 100

Fax +49 711 - 22 55 44 200

eMail vasb-fghggtneg@os-qverxg.qr

Internet www.bf-realestatefinance.de

Managing Directors

Fabio Carrozza

Francesco Fedele

Registered office of the company

Stuttgart

Place of jurisdiction

Amtsgericht Stuttgart: HRB 776987

Umsatzsteuer-ID: DE 342522696

Zuständige Aufsichtsbehörde für die Tätigkeit nach § 34c GewO:

IHK Region Stuttgart · Jägerstr. 30 · 70174 Stuttgart

Registrierung nach § 34 i Abs. 1 Satz 1 der GewO durch IHK Region Stuttgart am 20.09.2021.

Status: Immobiliardarlehensvermittler mit Erlaubnis nach § 34i Abs. 1 Satz 1 der Gewerbeordnung Aufsichtsbehörde: IHK Region Stuttgart, Jägerstr. 30, 70174 Stuttgart Registernummer: D-W-175-2DES-09

Die Eintragung im Vermittlerregister kann wie folgt überprüft werden: Deutscher Industrie- und Handelskammertag (DIHK) e.V. Breite Straße 29, 10178 Berlin, Telefon 030-20 308-0 oder www.vermittlerregister.info

Design: Rueckerconsult, Berlin

Technical realisation, Content-Management-System, Hosting: BRAND performance software GmbH, Bonn

Privacy Policy

Disclosures on the Website

The contents of this website were researched with the utmost care. At the same time, we assume no liability for the accuracy, completeness and currency of the information made available. In particular, the information are of general nature only, and do not represent any legally binding advisory. Each contribution reflects the opinion of its respective author.

All of the contributions and images published on the website are protected by copyrights. Any kind of use not permitted by the German Copyright Act requires the provider’s prior written consent. This applies in particular to the copying, editing, translation, storage, processing or reproduction of content in databases or any other electronic media and systems. Photocopies and downloads of web pages may be made for personal, private and non-commercial use only.

Data Protection Policy

This website is subject to the data protection policy of BF.direkt AG